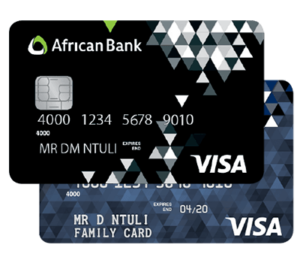

The African Bank Credit Card is a versatile and convenient financial option, offering a number of advantages and features that make its acquisition a smart choice. These include: payment flexibility, wide acceptance, rewards program, perfect limit, and more!

Let’s talk about some details of this card?

Advantages of African Bank Credit Card

- Payment Flexibility

The African Bank credit card offers flexibility in payments, allowing you to split your purchases into installments and choose the term that best suits your financial needs.

- Wide Acceptance:

This credit card is widely accepted in both domestic and international merchants, providing convenience and ease in your transactions.

- Rewards Program:

By using the African Bank credit card, you can benefit from a rewards program that accumulates points with every purchase you make. These points can be redeemed for a variety of benefits, such as vouchers, discounts at select partners, or even travel.

4. Online Banking:

The bank offers an intuitive and secure online platform, allowing you to manage your credit card conveniently. You can check your balance, view transactions you’ve made, make payments, and access your statement, all quickly and easily.

- Custom Credit Limit:

African Bank reviews each credit card application individually, taking into account your financial situation and credit history. This means that you will receive a personalized credit limit that is tailored to your needs and ability to pay.

How to get African Bank credit card?

To get a credit card, there are a few ways available:

- Online application: You can apply for this credit card through the bank’s official website. Fill out the application form and provide the requested information, such as proof of income and personal identification. The bank will review your request and contact you with the response.

- Bank branch: Visit an African Bank branch in person and talk to a bank representative. They will guide you through the necessary requirements and assist you with your credit card application.

- Call Center: Contact the African Bank call center for additional information about the application process and to provide the required documents. The attendants will be able to clarify your doubts and assist you in the procedure.

What you need to do to apply?

According to this bank, For an online Credit Card offer suited to your lifestyle, you will need to have the following documents on hand:

- Most recent proof of income.

- You must be over 18 to apply for a Credit Card

- Latest bank statement, reflecting three months’ salary deposits.

Always remember to read the terms and conditions of the African Bank credit card carefully before applying, ensuring that you are aware of all associated fees, charges, and liabilities.