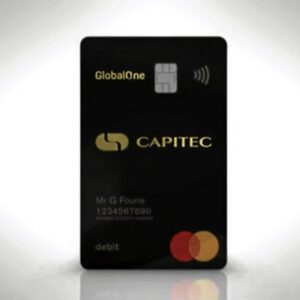

The Capitec Bank credit card is ideal for those who want a practical and secure card that can be applied quickly online.

With it, you can sign upto get a credit card with a credit limit of up to R500,000 from Prime.

You get free delivery and cash back on your monthly spending.

What are the benefits of the Capitec Bank credit card?

Spend with the credit card that fits your lifestyle and earn Prime interest, cash back and more!In addition from that:

- Credit limit up to R500,000

- Guaranteed 1% cashback on all your spending when you click, tap, swipe or scan to pay in store or online

- Zero currency conversion fees

- Free Local Swipes

- Free credit card delivery to your door

- Prime interest

Additional benefits include:

- Interest-free period of up to 55 days

- Safe and secure online shopping with retailers

- Free travel insurance up to R5 million

- Help build your credit record

- Earn 3.50% per year with a positive balance

- Credit insurance It isis available if you don’t have your own

Other details about the financial institution and the capitec bank card

Capitec Bank is a financial institution that offers a range of banking services, including the Capitec credit card. The Capitec Bank Credit Card is designed to provide customers with a convenient and secure way to shop and manage their finances.

One of the main advantages of the Capitec Bank credit card is its ease of use. With the card, customers can make purchases in physical and online establishments around the world, in addition to being able to withdraw cash from ATMs.

The card is accepted at millions of merchants, offering a wide range of purchasing options. Additionally, the Capitec Bank credit card offers customers a personalized credit limit based on their financial standing and credit history. This allows customers to have full control over their spending and avoid accumulating debt beyond their means.

Another important feature of the Capitec Bank credit card is its security. The bank uses advanced security measures to protect customer data and transactions.

Additionally, customers can activate additional security features such as real-time notifications for each transaction made with the card. Credit card management is also simplified by the Capitec Bank mobile app.

Customers can track their spending, view their available balance, pay invoices and set up personalized alerts directly through the app, giving them greater control over their finances.

What do you need to apply?

- Original ID document (must be 18 years or older)

- Latest salary slip

- 3-month bank statement

- The minimum salary requirement for a credit card application is R5 000 and R10 000 for self-employed clients