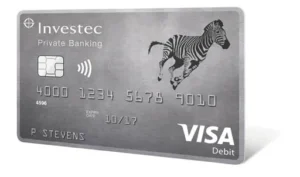

Have you heard of the Investec credit card? This card is part of Investec bank – an international bank and wealth manager.

According to the bank’s own information, whether you’re building your business, growing your family, or creating your legacy, the bank helps you understand your potential.

With years of experience in the market, the bank offers deep relationships with customers, building mutual trust and helping to make the extraordinary possible.

The bank was founded in Johannesburg, South Africa, in 1974 and has great credibility to this day

What defines the Investec credit card?

The Investec Credit Card is known for being a super elegant and sophisticated credit card, after all, Investec Online gives you control of your finances whenever you need it, from wherever you are.

Through the simple and intuitive online banking app, the customer has complete visibility of their online account. This means that he is always in control of your money, wherever you are in the world.

Credit Card Benefits

This credit card offers several benefits, including:

Rewards program: Cardholders have access to a comprehensive points program, where every purchase made accumulates points that can be redeemed for a variety of benefits, such as travel, luxury goods, exclusive experiences, and even bill payments.

In addition, Investec Credit Card provides its clients with a high level of security and fraud protection. Using advanced technologies such as two-factor authentication and real-time monitoring, the card aims to ensure peace of mind for its users during transactions.

Another differentiator of Investec Credit Card is the personalized customer service. Customers have access to a dedicated customer service team that is ready to help with any card-related questions or issues. This personalized approach creates a more satisfying and reliable experience for users.

In addition, this Credit Card offers additional benefits such as access to VIP lounges at select airports, travel insurance, and emergency assistance. These additional benefits are designed to meet the needs of frequent travelers and provide a top-notch experience.

Why be a part of this amazing bank?

- Service

Contact your Private Banker or the 24/7 global Customer Support Center or access digital channels such as Investec Online and App.

- Transact

Investec’ s private bank account consolidates all your day-to-day transactional banking services into one account with a platinum Visa credit card and a single transparent monthly fee. No annual or credit facility fees apply.

- Lend

Customized financials to help grow your business, property, or lifestyle assets, including finance to expand your professional practice or grow your investment portfolio.

Order your card right now!

All in all, the Investec Credit Card is a super reliable, sophisticated, and stylish option for anyone looking for a credit card in South Africa. With its attractive rewards program, personalized services, and focus on security, the card offers a comprehensive and rewarding financial experience for its cardholders.

In order for you to allow the bank to move forward with your application quickly, upload your documents using the document upload tool, available on the bank’s website