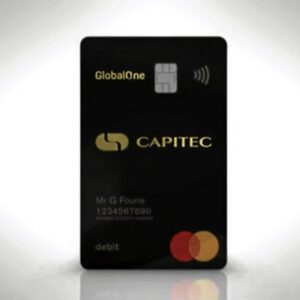

Capitec Bank Credit Card

The Capitec Bank credit card is ideal for those who want a practical and safe card that can be applied quickly online.

Apply online for a credit card with a credit limit of up to R500,000 from Prime. You get free delivery and cash back on your monthly spending.

CREDIT CARD

CAPITEC BANK CREDIT CARD

- Unparalleled Security

- Flexible Payment Options

You will remain on the current website

What are the benefits of the Capitec Bank credit card?

Spend with the credit card that fits your lifestyle and earn Prime interest, cash back and more! Furthermore:

- Credit limit up to R500,000

- Guaranteed 1% cashback on all your spending when you click, tap, swipe or scan to pay in store or online

- Zero currency conversion fees

- Free Local Swipes

- Free credit card delivery to your door

- Prime interest

Additional benefits include:

Interest-free period of up to 55 days

Safe and secure online shopping with retailers

Free travel insurance up to R5 million

Help build your credit record

Earn 3.50% per year with a positive balance

Credit insurance It isis available if you don’t have your own

Giovanni

Capitec Bank Credit Card

The Capitec Bank credit card is ideal for those who want a practical and secure card that can be applied quickly online. With it, you

Titanium Credit Card – Standard Bank – Incredible benefits

The Standard Bank Titanium credit card is a credit card option that offers its holders a series of benefits and distinct features. Standard Bank is

Standard Bank Blue – Trust, Convenience and Financial Freedom Guaranteed

Before we talk specifically about Standard Bank Blue, I need to tell you something: anyone who doesn’t want to have a credit card that brings